Client / Project: Bill Pay functionality for a digital bank company.

My role: Running user interviews, doing competitive analysis, facilitating workshops to gather requirements, designing the product and doing usability testings to measure the usability and desirability of the feature.

Problem: Bill payment can be a great feature to create stickiness for banks. However, its usage has been decreasing every year in the US as other functionalities arise.

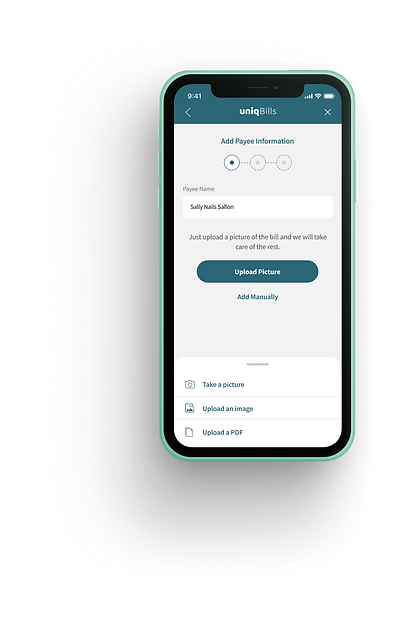

Solution: I suggested giving rewards to drive people to use the Bill Pay functionality and tested the bill payment set-up with 2 approaches. The 1st approach was via a Chatbot , and the 2nd was done conventionally via app but making it as simple as possible by adding modern solutions like inserting data from picture.

problem statement

This client was a brand new digital bank and was looking for feasible solutions that would add value to their bank, with the goal of creating loyal and long-lasting customers. The business recommended investing in a Bill Pay functionality, which is already very known in bigger banks and would be relatively easy to implement.

They wanted to know if the investment would really match their expectations regarding user adoption, once it's also known that the usage of the functionality has been dropping every year and is being replaced for other technologies such as AutoPay.

According to quantitative research by PYMNTS, 66% of consumers don't use their bank's bill pay functionality. The main reason is related to lack of rewards, alerts, and reminders. They also suggest that "consumer interest in tools that allow them flexibility and ease in managing their bills leads them to work directly with billers rather than their banks".

I wanted to help the business decision by bringing the voice of the customer to the table, so I decided to run some interviews before jumping into the requirements.

User interview: pain points and needs

I interviewed 9 business owners and started asking about their business and responsibilities.

Then I dived into open questions to find out about how do they pay and manage the business expenses, and what they understand by business bill. I also wanted to know if they are familiarized with the bill pay functionality from their bank. Do they use it? Why/ Why not?

Here's what I found out.

-

Merchants prefer to pay their business bills directly with the vendor, using either autopay or credit cards.

-

While the idea of a third-party bill paying service breeds mistrust, many merchants like to use the biller's autopay service so they can set-and-forget. Also, some vendors give discounts if you use autopay.

-

6 out of 9 participants mentioned that they have bills that change the amount every month (even fixed amount bills can change at some point) and the bill pay functionality their bank offers requires a bill in a fixed amount.

-

Automatic bill pay isn't always an option. Not all merchants have consistent, reliable income and pay their bills only when funds are available. 3 participants mentioned they were afraid of using bill pay due to a possible overdraft in their accounts.

-

Only 1 participant was currently using Bill Pay and enjoyed it. She felt safe using bill pay and have had issues using Zelle and lost money in the past.

-

2 participants didn't know what Bill Pay was, 3 knew but never used, and the remaining 3 have used in the past but eventually stopped using due to issues during bill updates and/or set up.

Design sprint: gathering requirements

The Design Sprint comprised of 3 hours and we had 9 participants, including myself. I invited for the session two product managers, who were very knowledgeable in digital banking capabilities and was going to translate all that into organized requirements. The product owner for the bill pay project, who knew the business goal and ways to achieve it. Two IT wizzards, that knew all about the core banking and APIs. And three members of the UX team to help with the session and, of course, give amazing inputs.

Step 1: Present research findings for reflexion and a quick competition analysis for inspiration.

I started the session by showing the insights from the user interviews and presenting a competition analysis for the Bill Pay functionality in known banks, such as Bank of America, Wells Fargo, and Discover. I also presented some features from Amex and Barclay to inspire the team to think outside the box.

Step 2: Goal and Brainstorming questions

The main goal for the session was "HMW make a bill pay service that is attractive and useful for the modern merchant?". But I wanted to get to more granular questions so that we could then solve and ideate for specific issues so we did a brainstorm session with HMW post its on the Mural board. After that, we did a voting session and selected the most voted HMW questions.

Step 3: Everyone skecth ideas!

Based on the most voted HMWs each member draw or wrote a solution in the board, whatever they felt more comfortable with. Then everyone presented their solution and the team voted on their favorite ideas

Solution

I started drawing a low-fidelity prototype based on the sprint outcome and trying to use as much as possible of the insights the team had given.

That way I could visualize the overall solution before jumping into Figma.

For the high-fidelity prototype, I used the company's design system and created a fake brand "uniqBills" to keep the company's privacy.

You can see the entire prototype in detail in this Figma link.

User testing

The test was done remotely via Zoom and recorded by Userlytics, and participants were given 3 scenarios.

-

Use the Chatbot to pay a bill.

-

Pay a bill from a vendor they recently transferred money to. There was no constrains here, and we wanted to discover which path they would take to accomplish the task.

-

Pay a bill from Comcast Cable adding the details manually.

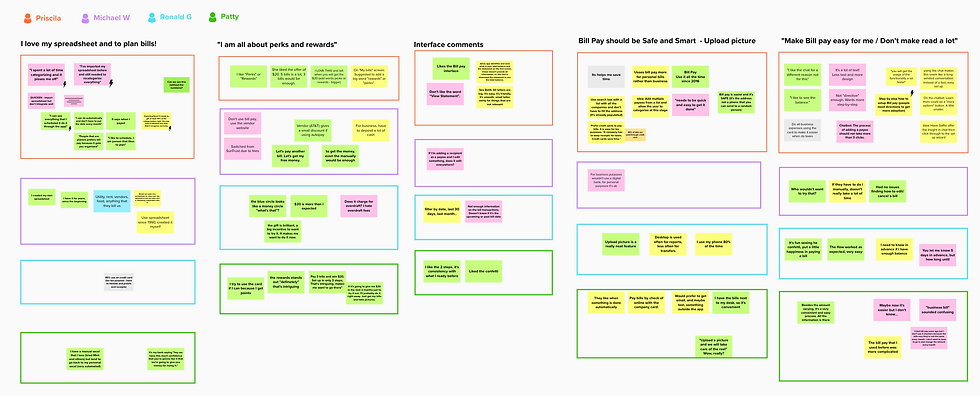

I then organized all the findings into an affinity map using Mural so that I could visualize happy moments (green) moments that could be improved (pink) and insights (yellow).

MAIN FINDINGS

Set up Bill Pay via chatbot

The chatbot was confusing to users because some of them didn't know what they should select or type.

-

Users were distracted by the many options and were not sure what to select

-

Overall the participants felt like the chatbot actually took longer than the regular screen set up

Users loved the functionality, but wouldn’t mind entering it manually.

-

All users naturally chose the ‘Upload picture > Take a picture’ flow in the first scenario

-

The technology has to work well not to cause any frustration

-

The feature would increase retention, and make them use it more often

-

The time spent during the manual was only slightly higher than the automatic picture flow

The gift is the biggest reason users would the Bill Pay functionality.

MAIN FINDINGS

Upload a Picture

MAIN FINDINGS

Rewards

-

3 users said $10 would be enough to make them try the bill pay

-

5 bills were too much. The 3 bills sounded very natural and a good amount for users

-

All users loved the incentive, and would definitely use Bill Pay after seeing it

"The gift is brilliant, a big incentive to want to try it. It makes me wanna do it now!"

"I have the bills next to my desk, so it's convenient. I'd just get my bills and take pictures."

"I like to use the chat for different reasons, not for this."

It was very easy to accomplish, but there was some confusion on what was a payee or a bill detail.

-

If a payee detail is edited, users want to make sure that was change for everywhere that they use that payee

-

The process felt easier than what they used before with other banks

-

They like the 3-step promise

-

Want to see a list of payees that have already been added

MAIN FINDINGS

Paying a Bill

"It was very easy. It's fun seeing he confetti, put a little happiness into paying a bill!"

KEY TAKEAWAYS

After gathering findings from both the initial research and the usability testing, I listed the following takeaways for the business stakeholders by answering the UX and business goal below.

UX GOAL: How might we make a bill pay service that is attractive and useful for the modern merchant?

BUSINESS GOAL: How might we make a bill pay feature that will bring stickiness and expand our customer base?

To make merchants begin to use the feature (attractive | expansion)

•Offer rewards! “Everyone likes free money” – Participant Quote.

•Be transparent about overdrafts, or don’t allow it to happen at all.

•Allow the users to set up bills that change the amount every month (electricity, credit cards...).

To keep merchants using it (useful | stickiness)

•Only use the picture functionality if it works seamless.

•Keep it simple, pay a bill in as few steps as possible.

Thanks for reading! If you have questions or suggestions, feel free to contact me.

Or you can jump to other projects by clicking below.